Running multiple businesses can be overwhelming, particularly when it comes to managing finances. Luckily, accounting software for multiple businesses provides a robust solution to streamline operations, minimize errors, and save valuable time. In this comprehensive guide, we will examine six ways this software can improve efficiency and give you a competitive advantage.

Table of Contents

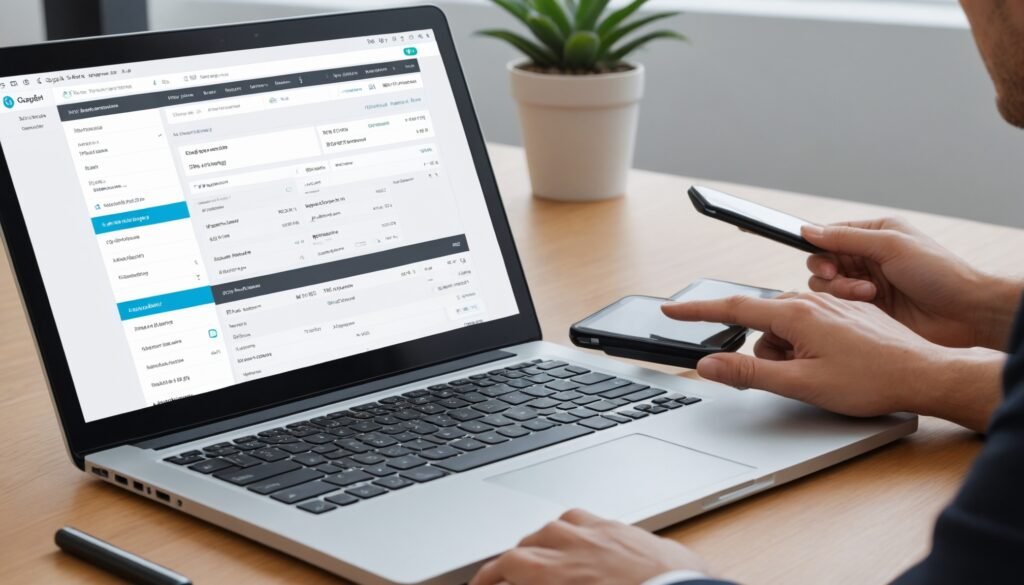

Centralized Financial Management

One of the most significant advantages of accounting software for multiple businesses is the ability to centralize financial management. Instead of juggling different systems or spreadsheets for each business, you can access all your financial data from a single platform. This consolidation not only saves time but also provides a comprehensive view of your overall financial health.

Centralized financial management means you can:

- Monitor cash flow across all businesses in real-time.

- Easily compare financial performance between different entities.

- Simplify the reconciliation process by integrating bank accounts and automating transaction imports.

Having all of your financial information consolidated in a single location enables you to access comprehensive and up-to-date data swiftly. This allows you to analyze the information thoroughly, empowering you to make well-informed decisions promptly. Ultimately, this capability positions you to effectively navigate and excel within a competitive market.

Automated Transactions and Invoicing

Keeping track of transactions and creating invoices manually can lead to mistakes and consume a significant amount of time. Accounting software for multiple businesses automates these processes, minimizing errors and allowing you to focus on more high-level, strategic responsibilities.

Key benefits of automation include:

- Recurring Invoices: Set up and schedule invoices to be sent automatically at regular intervals.

- Payment Reminders: Configure automated reminders for clients who have overdue payments, improving cash flow.

- Bank Integration: Sync your bank accounts to automatically import and categorize transactions, reducing manual data entry.

Utilizing automation in financial processes significantly reduces the likelihood of human error, leading to consistently accurate and up-to-date financial records. This increase in efficiency empowers you to direct your attention towards expanding your business, instead of becoming mired in time-consuming administrative duties.

Streamlined Reporting and Analytics

Creating financial reports for several businesses can be a daunting and time-consuming task. However, using accounting software specifically designed for managing multiple businesses can streamline this process by offering comprehensive reporting and analytical tools.

With these tools, you can:

- Create Customized Reports: Tailor reports to meet the specific needs of each business, whether it’s profit and loss statements, balance sheets, or cash flow statements.

- Compare Performance: Easily compare financial metrics across different entities to identify trends and areas for improvement.

- Gain Insights: Leverage built-in analytics to uncover valuable insights into your financial data, helping you make data-driven decisions.

Implementing streamlined reporting processes within your organization not only saves valuable time but also significantly improves the depth of your comprehension of your business’s financial status. This enhanced understanding empowers you to take proactive steps in managing your finances and enables thorough strategic planning for the future.

Enhanced Collaboration and Access Control

When overseeing operations for numerous businesses, it’s crucial to have efficient collaboration and secure data access. Accounting software for multiple businesses helps to streamline teamwork and safeguard sensitive information through its range of features.

Benefits of enhanced collaboration and access control include:

- User Roles and Permissions: Assign specific roles and permissions to team members, ensuring that only authorized personnel can access sensitive financial data.

- Real-Time Access: Cloud-based accounting software allows your team to access financial information from anywhere, promoting flexibility and remote collaboration.

- Audit Trails: Keep track of changes made to financial records with detailed audit trails, enhancing transparency and accountability.

This enhanced set of features is designed to enhance productivity by fostering seamless collaboration among your team members, all the while ensuring the security and overall reliability of your financial data.

Simplified Tax Compliance

When running multiple businesses with different tax obligations, staying compliant with tax regulations can be quite challenging. Fortunately, accounting software for multiple businesses can greatly simplify tax compliance by automating various aspects of the process. This includes automating tax calculations, filing deadlines, and ensuring accurate record-keeping for each business entity.

Key tax compliance features include:

- Automated Tax Calculations: Ensure accurate tax calculations for different tax rates and jurisdictions.

- Tax Reporting: Generate comprehensive tax reports to meet local, state, and federal requirements.

- Deadline Tracking: Keep track of important tax deadlines to avoid penalties and interest charges.

Automating tax compliance has numerous benefits for businesses. By implementing automated tax compliance systems, organizations can significantly reduce the risk of errors in their tax filings. This helps ensure that businesses remain fully compliant with all relevant regulations and requirements, thus mitigating the potential for penalties and legal issues. Furthermore, automating tax compliance can provide peace of mind to business owners and financial managers, freeing up their time to focus on other important operational and strategic tasks. Overall, the integration of automated tax compliance systems can streamline financial processes and improve overall efficiency within the organization.

Cost Savings and Scalability

Investing in high-quality accounting software for multiple businesses can result in substantial cost savings and contribute to the overall growth of your organization. The automation and efficiency provided by the software can lead to a reduction in administrative costs, freeing up resources for other aspects of your business. Additionally, the scalability of the software ensures that it can easily adapt and expand alongside your business as it grows and evolves.

Cost-saving benefits include:

- Reduced Administrative Costs: Automate manual processes to cut down on the time and resources spent on administrative tasks.

- Error Reduction: Minimize costly errors and discrepancies with accurate and reliable financial data.

- Scalable Solutions: Easily add new businesses or entities to your accounting software without the need for expensive upgrades or additional software.

Utilizing accounting software for multiple businesses has the potential to streamline and optimize your financial operations, leading to cost reductions and allowing you to concentrate on efficiently expanding your business.

FAQs

What features should I look for in accounting software for multiple businesses?

Can accounting software for multiple businesses handle different currencies?

Is cloud-based accounting software for multiple businesses secure?

How does accounting software for multiple businesses improve tax compliance?

Can I integrate accounting software for multiple businesses with other tools I use?

Conclusion

Accounting software for multiple businesses is a transformative tool that can significantly enhance your efficiency and productivity. By centralizing financial management, automating transactions, streamlining reporting, enhancing collaboration, simplifying tax compliance, and offering cost savings and scalability, this software empowers you to manage your businesses more effectively and focus on achieving your strategic goals. Investing in the right accounting software can revolutionize your operations and set you on the path to success.

Related Posts